At times we are compensated for the links you click at no cost to you. Learn more about why you should trust our reviews and view our disclosure page.

You’ve probably noticed an overall growing interest in sleep – people are more aware of how sleep quality affects their life. As a part of a booming sleep industry, the mattress market growth is also going through the roof with rapid development and increased sales. Many of us are curious about the actual numbers. Our expert team went through numerous mattress industry trends and statistics reports and is happy to share the findings. Read on for impactful facts and statistics in the mattress industry today.

Mattress Industry Key Statistics

- 69% of online shoppers opted for a mattress-in-a-box due to COVID-19 concerns.

- There are 9,134 bed & mattress store businesses in the US.

- About 32% of young people today are seeking hypoallergenic mattresses.

- About half of all Americans sleep on a queen-size mattress.

- Almost 50% of people under the age of 35 use some sort of sleep tracking device.

- The projected growth rate of the global mattress industry is at CAGR of 6.7% from 2019 to 2025.

- Tempur-Pedic has the highest customer satisfaction score of all the major players – 881 out of 1,000.

- Purple is the most loved bed-in-a-box retailer with a score of 875 out of 1,000.

- Innerspring mattresses are the most popular on the market, but it is estimated that memory foam mattresses will take their place in the coming years.

Mattress Market Slows Down Due to Record Inflation

If you look at almost any mattress market research report or trends analysis report prior to 2021, you’d see that the expectations for the market growth are high. The industry was expected to increase in value by billions by 2025 or 2030.

However, the opposite is currently happening – some of the most popular companies, Tempur Sealy International’s brands (Tempur-Pedic and Stearns & Foster) have had fewer sales since 2021.

Why aren’t people buying mattresses more in 2022?

The Covid sales spike has ended and during that period, most shoppers who were planning to buy a mattress did so. Around this time there was plenty of room to focus on improving home comfort. Now the sales are slowing down – partly because of the preceding spike, partly due to other key factors.

With higher job insecurity, rising inflation, and an overall unpredictable market, fewer shoppers are willing to invest in anything big – including mattresses.

As shopping trends taper off, mattress manufacturers are unable to lower the prices in order to increase sales. Rising fuel prices need to be covered, so brands pass on fuel costs to mattress retailers, who then pass them on to consumers, according to Seeking Alpha.

Online retailers aren’t spared because rising supply chain costs also affect their prices. Purple Innovation, Casper, Sleep Number Corporation, and others are witnessing a weaker-than-expected revenue.

How Covid-19 Pandemic Affected Mattress Sales and Trends

The pandemic has pushed a lot of real-world human activity online, and as a result, online mattress sales increased.

However, mattress purchasing isn’t a small project, so the majority of people of all ages still prefer brick-and-mortar stores where they can actually go to physically touch and try out a mattress.

Revenue for the mattress manufacturing industry increased by 8.3% as compared to the previous year. This increase is connected to the Covid-19 pandemic and orders to stay at home.

Age and mattress shopping habits

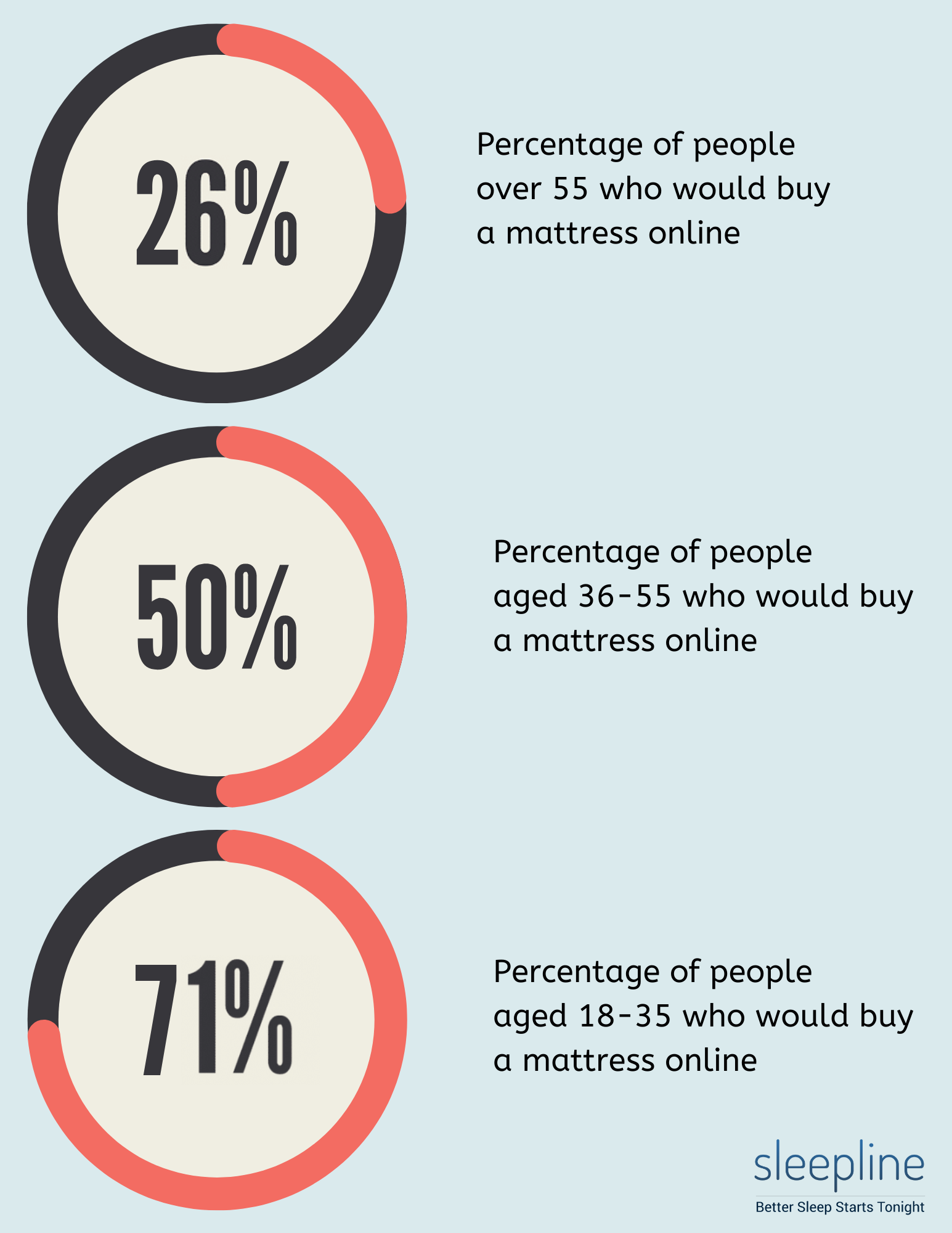

People over 55 are the least likely to opt for purchasing mattresses online (26%), while those in the group of 36-55 are much more likely to do so, with 50% of them saying they’d give it a try. As expected, the youngest group (18-35 years old) is the most likely to shop online for a new mattress. A little over 70% of them think it’s a good idea.

Brick and mortar vs. online sales

Mattress purchases have increased both online and in-store during the pandemic. Whether it is due to people staying at home more, or due to all the attention that sleep quality gets in the media, brick-and-mortar stores saw a 2% increase since 2016, whereas online sales jumped by a staggering 20%.

Although brick-and-mortar stores didn’t see a dramatic decrease in sales, there has been a total of 21% decrease in customers who only visit mattress stores to look around.

Shoppers switched to online shopping because of Covid

While 25% of shoppers said they had no time for shopping in person and 41% claimed that they found a better price online, the reason number one for online shopping was Covid. As many as 69% of shoppers said that they didn’t visit a store precisely because of the pandemic.

The US is the Biggest Global Online Mattress Market

Based on the mattress industry statistics, the US online mattress market is the biggest in global e-commerce. In the first half of 2022, it had a revenue of $13,751 million, which is about 18% of the entire world’s revenue from selling mattresses online.

This may come as no surprise because we could witness the strong competition among mattress-in-a-box brands in the past several years. Right now, there is a total of 175 online mattress companies in the US!

Current Trends in Consumer Preferences

Each year, about 36 million mattresses are sold in the US. That’s close to 70,000 per week! With such a huge market, every company that hits the sweet spot of consumer preferences can expect decent to really high revenue.

Comfort and support

Recent trends among mattress shoppers indicate that the absolute majority of 83% seek comfort and support as the main reason to buy a mattress. If we break down comfort and support into more details, we get the following percentages of consumers:

- 43% prioritize back support

- 33% prefer a firm mattress while 20% prefer a soft mattress

- 26% think pillow-top mattresses have the right balance of comfort and support

- 20% want a contouring mattress

- only 14% value motion isolation above all else

Other priorities

Aside from the comfort/support combination, consumers also value other features:

- 57% say that size and thickness are important

- 56% prioritize materials and construction

- 40% values company reputation

- only 17% stick to a brand

- just 16% value technology that goes in the mattress.

Preferred mattress type

Spring mattresses are in great demand – in fact, they are the most popular mattresses among consumers. However, the majority of spring mattress owners are not happy with their mattresses. They just aren’t good at pressure relief because they have a simple coil system and a very thin comfort layer on top.

This might be the reason why close to 34% of consumers think that pillow-top mattresses are the best type.

The second place is shared by hybrid and foam mattresses, each of which is preferred by 22% of consumers.

With rising awareness of mattress toxicity due to materials and chemicals used in production, consumers could be steering towards organic and natural mattresses in the future.

Projections for the Mattress Industry Development

Prior to the inflation, market growth was projected to skyrocket. Looking at the latest market changes, especially the ones going on right now, the predictions may not be so accurate.

Still, the public is so much more informed about the importance of sleep now than they were in the past, so the entire industry is highly likely to keep growing, albeit at a somewhat slower pace. Most projections say that it will grow by $13 billion in value over the next five years.

Consumer trend projections

First off, it is projected that young people will keep buying mattresses online. This doesn’t mean that brick-and-mortar stores will become obsolete. Shoppers in all sectors tend to do the research online, and then head to a physical store to actually touch and try out a product.

Mattress shoppers may replace their existing mattresses sooner than they did in the past, as the mattress lifespan expectations have decreased.

Fun Facts about the Mattress Industry

- The expression “sleep tight” comes from the way in which mattresses were supported in the past. People used ropes that were cross-woven and stretched across frames.

- Mattresses need to be flame-proof by federal law.

- Mattresses can weigh a lot more after 10 years of use because skin cells, dust mites, sweat, etc. accumulate in them.

- A typical mattress lasts 7 to 10 years, with some lasting several years longer.

- The Guinness World Record for mattress dominoes is 2,019 mattresses – and it was set in 2019.

- Sealy is the biggest mattress manufacturer in the US.

Frequently Asked Questions

Yes. The global mattress market is huge. Asia-Pacific and the US are dominant mattress markets with the fastest growth, and their value is estimated at tens of billions in revenue. The current inflation has slowed the sales down, but the market is still expected to grow.

The mattress industry is developing quickly. Brands are more and more moving towards online sales, innerspring mattresses are expected to decline in sales and be replaced by memory foam mattresses or other types.

Most mattresses sold are innerspring mattresses. However, the most loved brands are Tempur-Pedic among regular sellers and Purple among online mattress companies.

In 2018, 45% of all mattresses sold happened online, according to International Sleep Products Association. Today that number could be much higher.

Conclusion

The mattress market trends have been and are predicted to keep changing in the near future. More shoppers are willing to buy a new mattress online, and with a high number of those who are unhappy with an innerspring mattress, we can expect a rise in sales of memory foam mattresses or hybrid mattresses. Most customers are looking for a comfortable and supportive mattress and they are more likely to replace their old mattresses sooner. However, major companies as well as the smaller ones are not seeing a steady increase in sales as the Covid-19 sales spike tapers off, and are rather seeing a slowdown due to inflation.

Next step: Now that you know everything there is to know about the mattress industry, it’s time to take a look at some of the products that are available. We created a list of the best mattresses with Afterpay financing that you can buy if you’re shopping on a budget.

Related product reviews:

Psst… the sleep review industry is full of liars, sharks, and thieves. It’s a modern-day version of getting ripped off at your local mattress store. So, why should you trust us?